VNG's IPO Plan - Novel and Unprecedented

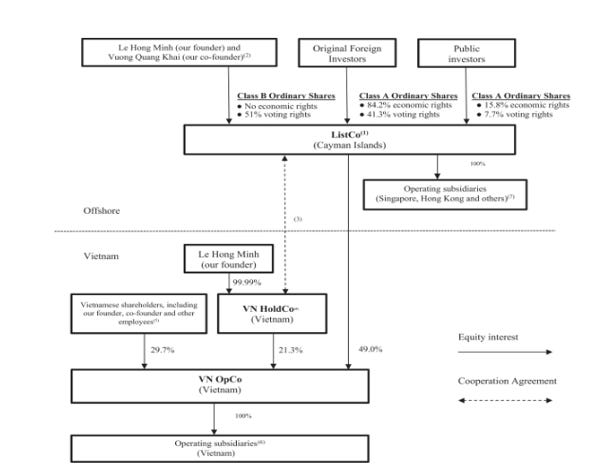

Part 3 – Class B, Class A shares of ListCo, the most controversial part of the structure

The design of the voting structure is to ensure the “control” of the founding-shareholders over the whole business. This is nothing unusual as VNG already described in form F1 that they are “a founder-led public company with Vietnamese roots” and therefore, the governance structure should reflect this vision.

The voting structure in ListCo is comprising of (A) holders of Class B ordinary shares with 10 (ten) votes per share, (B) holders of Class A ordinary shares with 1 (one) vote per share. Upon the completion of the IPO, the voting structure of the ListCo will be as follows:

The founders will have all Class B ordinary shares with 51% of the voting right;

The Original Foreign Investors will have a majority portion of Class A ordinary shares with 41.3% of the voting right;

The public will have a minority portion of Class A ordinary shares with 7.7% of the voting right; and

The economic right will be shared among the public and the Original Foreign Investors.

The innovation and also the controversy in this part of the structure is the “legal interpretation” relating to the nature of Class B ordinary share of ListCo in the context of Vietnam’s investment laws and regulations.

Issuance of shares in offshore company and registration of outbound investment

Typically, to own shares, one must make an investment.

In Vietnam, if Vietnamese persons want to make an investment to a foreign country, such persons must go through a registration process of outbound investment with Vietnamese authorities.

Therefore, Vietnamese persons who want to own shares in foreign companies must register such outbound investment with Vietnamese authorities. This is a lengthy process and subject to heavy scrutiny from Vietnam authorities.

The argument of VNG and A&O with relating to the issuance of Class B ordinary shares to founders

VNG seems to have a work around with relating to the issuance of Class B ordinary shares to the founders without registration with Vietnamese authorities.

Under Vietnamese laws, an “investment” shall have the following elements:

To invest capital;

For the purpose of doing business; and

To derive profit from such business activity.

While it’s not expressly provided in form F1, VNG seems to rationalize that (A) Class B shareholders are not required to pay anything to ListCo to own Class B shares, therefore, they make no investment of capital, and (B) Class B shareholders do not entitle to any kind of distribution, dividend of ListCo (including upon liquidation), therefore, they do not derive any profit from Class B ordinary shares. Based on these rationales, there is no investment being made by the founders to the ListCo to own Class B shares and thus, there is no registration being required under Vietnamese laws with relating to the issuance of Class B shares to the founders.

The interpretation is also backed up by a legal opinion from Allen & Overy Legal (Vietnam) Limited Liability Company which states that “the issuance of the Class B Shares to the Founder and the Co-Founder does not violate any provision of Vietnamese law or regulation.” Until today, it is still a surprised to me as to the extent of the legal opinion of A&O with relating to the issuance of Class B ordinary shares.

Personal opinions

The interpretation has some problems which need to be further considered, in particular:

Regarding the Company Act of the Cayman Islands, expertise may vary, yet Class B shareholders are required under ListCo’s SECOND AMENDED AND RESTATED MEMORANDUM AND ARTICLES OF ASSOCIATION (“Article of Association”) to fully pay for their Class B shares with the par value of USD of US$0.000001 per share. Hence, as and when the founders make the payment for Class B shares to the Listco, the founders will “invest the capital” in ListCo (an offshore company under Vietnamese laws).

The purpose of ListCo is to do business and to make profit.

The value of ListCo, as it continues to grow, will drive the value of the element of “controlling” of the business and therefore the value of Class B shares. Class B holders could make a fortune if they are to sell their right to control the business through the transfer of their shares as long as the transfer is permitted under the Article of Association.

Therefore, arguing that there is no investment being made by the founders to own Class B ordinary shares is more about “form” than “substance” of the whole scheme.

Preliminary conclusion

These post are not everything I want to discuss about the VNG’s IPO Plan (as there are some other interesting issues such as the merger filing requirement under Vietnamese laws for the structure, the consolidation of VNOpCo into the balance sheet of ListCo, etc.) but I want to end the whole series here to move to another exciting transaction.